Scaling internationally is a high-stakes game. One mispriced decimal or an untested payment flow can turn a high-value customer into an abandoned cart statistic. Below is a comprehensive playbook for ecommerce leaders who want to conquer the complexities of multi-currency and local payments, while navigating shifting tariffs and regional financial apps, to turn potential friction into competitive fuel.

-

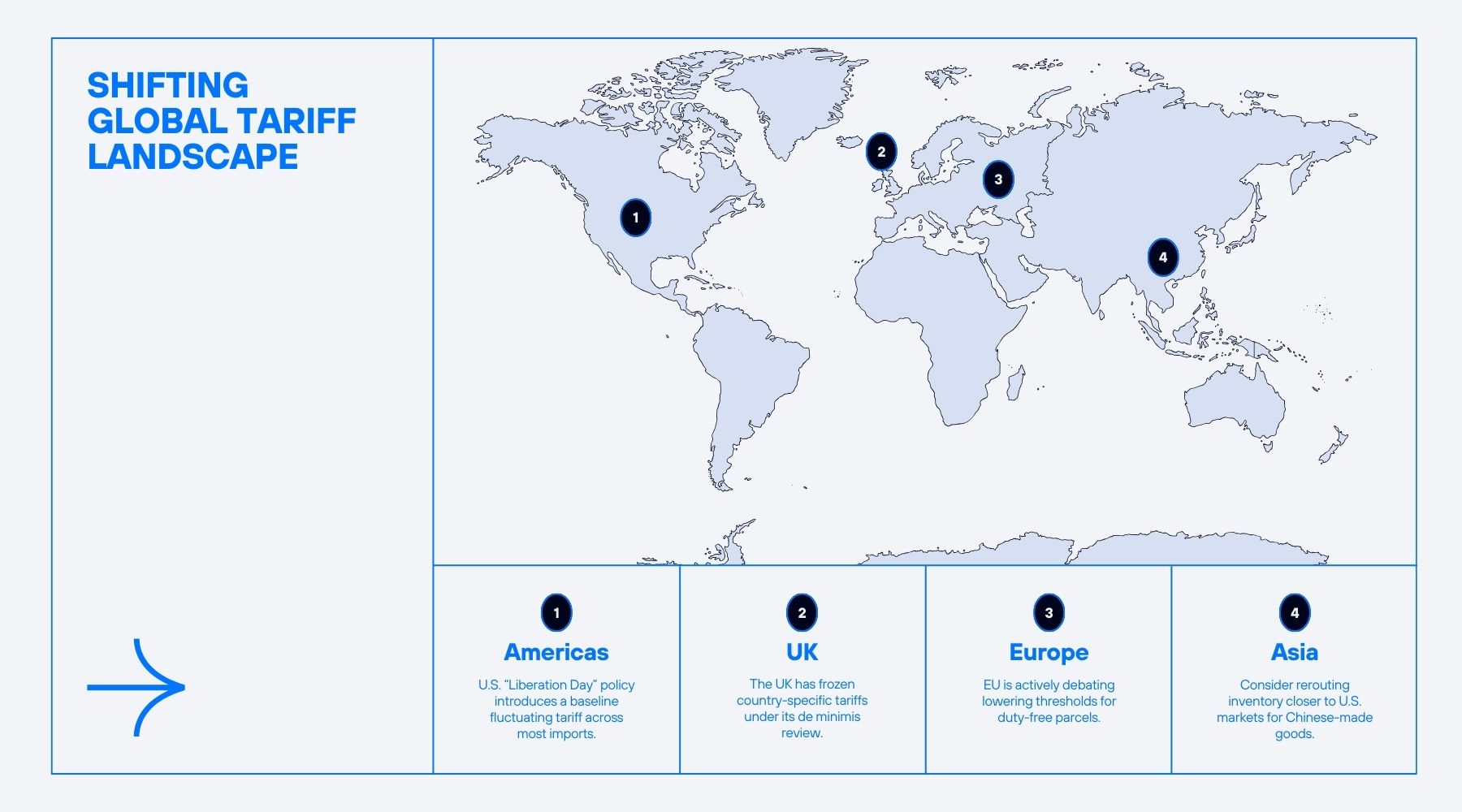

Navigating the new tariff landscape

Even flawless currency conversion won’t save you from unexpected duties. Recent policy moves have reshaped the calculus for cross-border sellers:

- Global Reciprocal Tariffs: Under the April 2 White House “Liberation Day” orders, a baseline constantly fluctuating tariff now applies to most imports to the US, with surcharges for different countries changing at lightspeed, businesses have to be more agile than ever.

- EU & UK Considerations: The EU is debating a threshold cut for low-value imports, while the UK recently froze country-specific tariffs under its own de minimis review—signals that the free-flow era of ultra-cheap, duty-free parcels may be ending globally.

Action Items:

- Duty Pre-Calculation: Pull live customs data into your checkout to display duties and taxes alongside the converted price.

- Fulfilment Diversification: Test shifting inventory closer to key markets (e.g., U.S. warehouses for Chinese-made goods) and compare landed-cost models.

- Tariff Alerting: Integrate automated reminders for policy changes in your top three markets—so rate-feed adjustments and price tiers stay in sync.

-

Real-time rates + intentional rounding

Dynamic pricing is table stakes, but only if it feels right to local shoppers:

- Tier-One FX Feeds: Use providers with sub-minute refresh rates and SLAs—cache locally for 5–10 minutes to balance performance and freshness.

- Smart Rounding Rules: Match cultural norms: round Japanese Yen to the nearest ¥100, Brazilian Real to “.90” or “.99,” and UAE dirhams to “.00.” Define min/max spreads so your converted prices never undercut internal margins.

Pro Tip: Run A/B tests on 0.95 vs. 0.99 endings in each market; Digivante UAT cycles have driven up to 7% CVR lifts by aligning pricing signals with local psychology.

-

Discoverability & persistent preference

Hiccups in currency selection cost revenue. Make it frictionless:

- Auto-Detect & Pre-Select: Combine IP geolocation with browser locale to default the customer’s local currency on page load—without interruptive pop-ups.

- “Sticky” Currency Widget: A slim header bar or floating icon keeps the selector one tap away on mobile and desktop.

- Memory Across Sessions: Store currency choice in cookies and user profiles. 60% of repeat cross-border visitors will insist on their preferred currency each visit.

-

Crystal-clear price presentation

Customers won’t hunt for hidden fees—surface them upfront:

- Embedded Duties & Taxes: Show an “Estimated Total” on the product page. Early transparency cuts abandonment by up to 20%.

- Dual-Display Equivalents: Underneath “€249,” add “≈£214” in lighter type.

- Locale-Aware Formatting: Leverage ICU libraries (e.g., formatNumber in JavaScript Intl) to handle decimal separators, thousands delimiters, and symbol placement.

- Source Attribution: A small “Based on XE rates, updated every 30 s” tooltip builds trust.

-

Checkout integrity: Test every edge case

Even minor glitches at checkout can wipe out gains from your currency engine:

- Promo & Currency Stacking: Ensure a €10 voucher issued in EUR applies correctly when the shopper switched to USD.

- Gateway Compatibility: Verify each PSP supports your full currency roster without hidden FX markups.

- Confirmation Consistency: The total on-screen, email, and PDF invoice must match exactly—pixel-perfect.

Digivante Crowdtesting Advantage:

Real users in Mexico, Malaysia, Mauritius, and everywhere in between validate every permutation—currency toggle, VAT inclusion, payment method, promo code—unearthing rare “1 cent off” bugs before they bleed revenue.

-

Beyond currency: The rise of local payment apps

In many markets, credit cards play second fiddle to homegrown wallets:

| Market | Dominant App(s) | Key Stats |

| China | Alipay, WeChat Pay | Alipay serves 1.3 billion users (2020) Wikipedia; WeChat Pay has 1.133 billion (2023) Wikipedia |

| South Korea | KakaoPay, Toss | KakaoPay logged ~24 million MAU in Q3 2024 MK News; Toss claims 20 million MAU in 2024 |

| India | UPI (PhonePe, Google Pay, Paytm) | UPI volume hit 13 billion transactions in April 2025 (NPCI report) |

| Brazil | Pix | 170 million users, 4 billion transactions/month (Feb 2025) – Central Bank of Brazil |

| Europe | iDEAL (NL), Giropay (DE), others | iDEAL processes €100 billion/year; Giropay ~5 million users |

Integration Tips:

- Embed wallet-specific SDKs and test flows end-to-end (including 3DS, tokenisation, QR codes).

- Spotlight popular local methods on your PDP and checkout pages—“Pay with KakaoPay →” or “Scan QR to Pay via WeChat Pay.”

- Run market-specific Digivante sprints: real devices, native apps, and region-locked accounts reveal idiosyncratic UX bugs.

-

Content localisation for conversion

Pricing is just one pillar. The rest of your page must feel homegrown:

- Micro-Copy Tuning: “Add to Bag” vs. “Add to Cart,” “Secure Checkout” vs. “Finalise Purchase”—adjust per locale.

- Regional Imagery: Swap hero banners to showcase local landmarks, models, or seasonal cues.

- Trust Badges & Local Social Proof: Display testimonials from customers in that market (“Loved it! – Maria, São Paulo”) and include region-specific certifications (ISO 9001, Fair-Trade, carbon-neutral).

-

Metrics that move the needle

Track these KPIs by currency and payment method:

| Metric | Impact | How to Monitor |

| CVR by Currency | Reveals underperforming price points | Segment in GA4 / Shopify reports |

| Cart Abandonment by Locale | Highlights friction hotspots | Funnel visualisation & real-time alerts |

| AOV Delta Post-Fix | Measures lift from transparent duties & rounding | Time-series AOV by currency cohort |

| Payment Method Adoption | Tracks wallet vs. card use | PSP dashboard + custom tagging |

| Rate-Feed Latency | Ensures currency feeds keep pace | Synthetic monitoring on your rate API calls |

-

Executive buy-in: Building the business case

- Revenue Uplift Projections: Show how a 1% CVR lift in Germany or Brazil translates to €X million annually.

- Risk Mitigation: Quantify revenue protected from surprise tariff hikes (e.g., April’s U.S. de minimis change cost some brands 2–4% of sales) AxiosReuters.

- Competitive Edge: Demonstrate how local payment integration reduces checkout time by 30% and increases wallet adoption by 50%—locking in high-LTV customers.

Every decimal, every payment path, every policy shift matters. By combining dynamic currency engines, dialed-in rounding, seamless wallet integration, rigorous crowdtested QA/UAT and proactive tariff management, ecommerce leaders can transform complexity into a scalable growth lever—one market, one currency, one cart at a time.

Partner with Digivante today to stress-test your multi-currency flows and unlock your true global potential.